What is Service Line Coverage and do you need it?

Service line coverage is a newer coverage that will pay for the repair or replacement of exterior underground water and sewer piping, electrical service lines, and data lines that fail or are accidentally broken and that are owned by the homeowner.

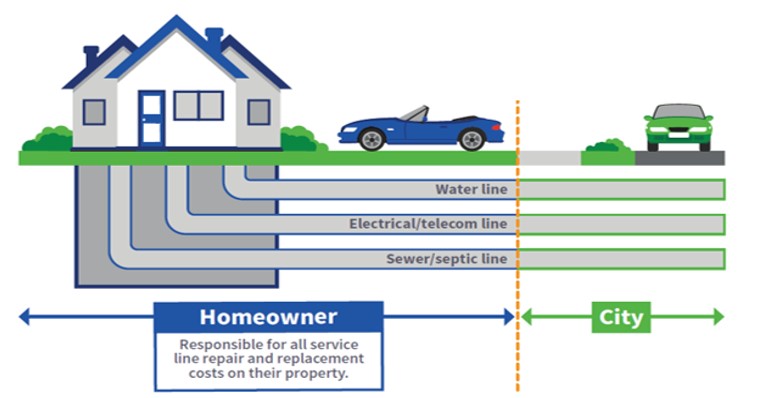

Most homeowners don’t realize that the outdoor service lines between their home and the street are owned by them.

As a homeowner you are responsible for the maintenance of the service lines on your property in the event that they fail. Service Line Coverage will fill the gap in the coverage in your homeowners policy which typically will exclude this coverage.

A service line failure is physical damage that results in a leak, break, tear, rupture or collapse of a pipe or line. Physical damage can be caused by external events such as accidental breakage or environmental conditions such as root invasion, deterioration, freezing and electrical arcing.

The cost of repairing these lines can be expensive; running into the tens of thousands of dollars in some cases. This is a large amount of money! In addition to the repair to the service lines, the coverage can also pay for hotels, meals, rent, or other living expenses when a family must leave their residence because of a covered loss, or for generators and other temporary equipment needed to remain in their home. In addition, it covers damage to outside property, including trees, shrubs, sidewalks, decks and landscaping when caused by a service line failure.

Here is a real example of just how quickly this can happen. A homeowner suddenly experienced a drop in water pressure. They walked out to their yard to find a large pool of water in the middle of their back lawn. It didn’t rain, so they didn’t understand why the lawn was flooding. They called a plumber ($$) who used a specialized snake camera to investigate. It turns out that an old pipe had deteriorated and there is now a leak. This was on their property. They had to repair the pipe ($$) and prevent more damage from being done. This included digging up their lawn and driveway, replacing the pipe and redoing the landscaping and concrete ($$). They even had to live elsewhere during the lengthy repairs ($$). This was expensive. They didn’t have Service Line Coverage. They do now.

If this happens on your property, it’s all your responsibility and the typical homeowners policy does NOT cover damage to service lines. Luckily, a Munn Insurance homeowners policy through Aviva can now help with the introduction of a new Service Line Coverage. The service line coverage we can provide is designed to cover the unexpected costs outlined above.

Causes of loss may include:

- Wear and tear, rust or corrosion

- Tree roots, fallen trees or weight of heavy equipment

- Rodent or insect damage

The most concerning of the service line damage is water and sewer lines. These can cause the most damage. Common warning signs that your water or sewer lines are damaged include:

- Discolored water. Have you recently noticed that your water is cloudy or discolored? This could mean that rust, or even soil seeping through cracks in the piping, is reaching your water supply.

- Pools of water on your lawn or street. Have you looked out your window to find that your lawn or street has puddles that weren’t there before, even if it hasn’t rained recently? When water begins to pool in surprising places, something isn’t right. Ensure that any irrigation system is working properly and call in an expert if you can’t easily fix the problem. This standing water could cause dangerous sinkholes and is a sign of a serious water line problem.

- Low water pressure. Consistently low water pressure could mean that your line has a leak. If your water pressure is extremely low, the issue could be severe.

- Pipe corrosion. Being proactive can save you a lot of money in the future. Inspect your water line pipes regularly for signs of rust and corrosion. If you get to it early enough, you can have someone replace or repair the piping before it becomes a pressing issue.

- Structural water damage. This can be one of the most expensive problems to fix, so if you see any signs of structural damage, you need to have it looked at immediately. When a water line breaks, the water can leak under your structure. Since concrete absorbs water, cracks can form. These can compromise the structural integrity of a building. This is very bad and potentially dangerous for all of those who are inside the structure. If you notice these cracks at any time, do not hesitate in contacting the proper professionals.

- Strange noises. If you hear a strange bubbling or gurgling when using your faucets or flushing your toilets, this can be a sign that you have a serious leak. A delay in finding the cause of this issue could result in more water damage.

Generally, a claim on this coverage includes the repair of damaged service lines up to $25,000 including:

- Excavation costs

- Repair costs – driveway and walkway repair, trees and plants, landscaping, etc.

- Additional living expense coverage

- Damage to outdoor property and replacing them

Covered service lines vary, but may include:

- Water lines

- Sewer lines

- Power lines

- Communication and data lines.

- Geothermal Plumbing (Ground Loop Piping)

There may be exclusions for certain lines associated with septic systems, sump pumps, irrigation lines, fuel tanks, water wells and heating/cooling systems.

Here are some frequently asked questions and responses:

- Which service lines are covered?

- Underground sewer/septic line, watermain, electrical, telecommunications, and geothermal plumbing (ground loop piping) are covered.

- Are tree roots covered?

- Yes, if both the failed service line and the tree root or plant that’s causing the line failure or blockage are on your property.

- Am I covered if my home becomes uninhabitable?

- In the event of a claim, you’re covered for additional living expenses if your home becomes uninhabitable.

- Is my driveway, walkway and other landscaping covered?

- Yes. Trees, plants, shrubs and lawns are covered up to $1,000 per tree, plant, shrub or lawn including debris removal expenses up to the amount shown of your Certificate of Insurance.

- Customer: Do I have a deductible?

- Yes. You’re covered up to the amount shown on your Certificate of Insurance for this coverage, less your policy deductible, which is the amount that you will pay.

Munn Insurance is now offering this coverage to all new customers and adding it to the policies of our existing customers who are eligible (those with an Aviva homeowners policy); unless they decide to decline the coverage. If you don’t have it on your policy, it is something to strongly consider. This coverage is available for just $5 per month (or $60 per year) and the coverage is available for a $25,000 limit.

Since service line repairs can cost in the tens of thousands of dollars, having Service Line Coverage at a reasonable cost ($5 per month), especially for older homes with outdated utility lines, is important to enhance the coverage and protection you have in your homeowners policy.

To learn more about Service Line Coverage and ensure you are properly covered, call us today at 1-855-726-8627.

Related News

Recent News

How to Save on Insurance Amid Uncertainty of Tariffs and Trade Wars

In today’s global economy, trade wars and tariffs are a hot topic, and their potential impacts reach beyond just the cost of goods like cars, appliances, and steel. If tensions between countries like Canada and [...]

Get the Best Auto Insurance Quote in Nova Scotia: A Step by Step Guide

When it comes to auto insurance, everyone wants to ensure they’re getting the right coverage at the best price. Whether you're a first-time car owner or a seasoned driver in Nova Scotia, the process of [...]

Unlock Big Savings with Group Insurance Discounts

At Munn Insurance, we know that everyone loves saving money—especially when it comes to home and auto insurance. Did you know that you may qualify for exclusive discounts just by being part of certain groups [...]